Life Insurance for the year ahead

With the Omicron variant of Covid ramping up worldwide, 2022 looks set to continue the theme of the decade and life is still very much impacted by the global pandemic. But outside of the virus, if the last two years have taught us anything it is that the unexpected can, and will happen.

From fires to accidents, you simply don’t know what will happen in the future. Fortunately, there are a number of comprehensive insurance products designed to protect you against the uncertainties and risks you’ll be facing in the future and, in a worst-case situation, provide for your loved ones after you’re gone. Offering you financial support after an accident or illness, through to supplying long term wealth management for your family, life insurance products in Hong Kong are a flexible yet comprehensive solution to ensuring you and your loved ones have the support needed no matter what happens.

What is life insurance?

In Hong Kong life insurance is defined as: an insurance policy providing a sum of money if the insured dies while the policy is current. As can be seen under this definition, life insurance is a Benefit product, and not an indemnity insurance product.

Although the definition is technically true, many modern life insurance products in Hong Kong will actually offer far-expanded coverage benefits beyond death of the policyholder. Under the life insurance umbrella in Hong Kong coverage is available for:

- Death Benefits

- Disability Income Protection

- Critical Illness Insurance

- Personal Accident Insurance

- Medical Cover

While Life Insurance was originally conceived to assist a person’s family or business should they die unexpectedly, modern plans offer flexible layers of protection to give you the assurance that your loved ones will always have access to the finances and money that they need to maintain their lifestyle.

Term Life Insurance

Term life insurance is the simplest form of life insurance cover available in Hong Kong.

With a term life policy, the plan runs for a specific length of time – known as “the term.” Should the insured life die during the policy’s term, then the named beneficiaries on the policy will receive a financial settlement.

Essentially, Term Life insurance is a bet that the life being insured will end during the term of the policy. This is not a bet that you necessarily want to “win,” but the structure of a term life policy is simple enough to understand that this type of coverage makes sense for a majority of people in Hong Kong. Having said this, however, there are option under term life for you to select in line based with your personal needs. Options provided include:

- Level, Decreasing and Increasing Term Life Insurance

- Renewable and Convertible Term Life Insurance

- Endowment Term Life Insurance

Even with these additional coverage options, term life insurance normally offers a pure death benefit – a financial settlement in the event of the insured’s death. This keeps things simple and makes planning for the future an easier affair than it would be without the guaranteed of incoming financial support. There are no restrictions on how the benefit can be used, and survivors will normally put money towards the costs of funeral expenses, education, rent and mortgage payments, and any other financial responsibilities they may have.

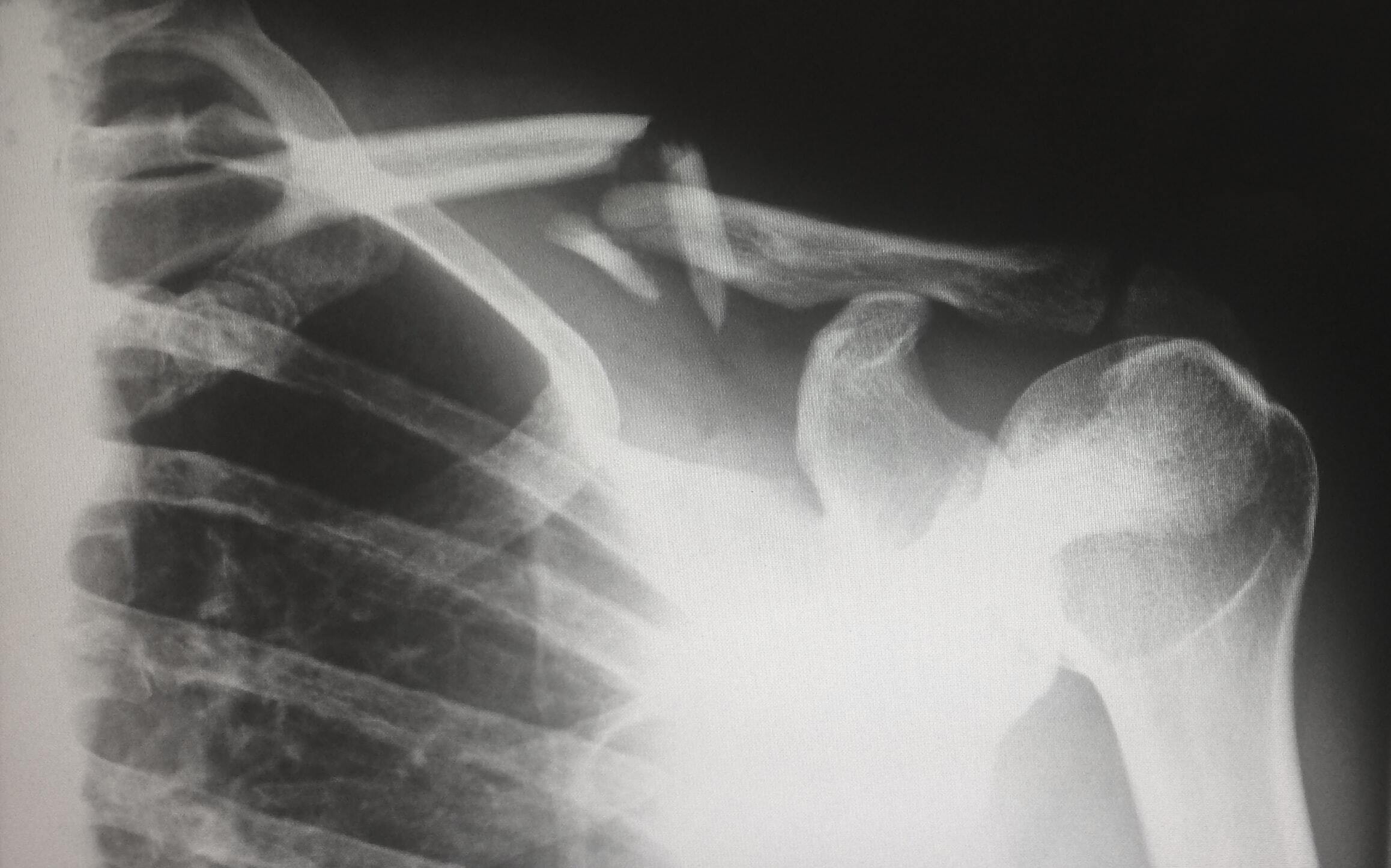

Personal Accident Coverage

The obvious gap in Term Life insurance is in situations where the insured life is seriously injured, but does not die. Because Term Life insurance offers a death benefit, no financial support is provided by the policy in any other situation.

Personal accident insurance is an excellent addition to supplement your life insurance coverage.

Personal accident insurance is designed to provide a settlement to you should you experience an accident or covered traumatic incident which results in death, dismemberment, loss of limb, or other traumatic injury. The exact claim amount you’ll receive under a personal accident insurance plan will depend on the extent of your injuries and the severity of the accident. It should be noted that the death benefit associated with a personal accident policy will normally be less than the death benefit of a life insurance product.

If you lost your hearing or received serious burns to your body, a personal accident plan will provide you with a financial settlement to maintain your lifestyle while in recovery. Larger settlements will be provided to policyholders who have more serious injuries.

But what happens if you are sick and unable to work, rather than injured?

Critical Illness Insurance

If you develop a long-term debilitating illness like cancer, stroke, Parkinson’s disease, multiple sclerosis, or suffer organ failure, then a Critical Illness policy is able to support you and your loved ones while you receive treatment and recover.

In essence, a critical illness policy supplies you with a financial benefit should you become seriously sick. This money is paid directly to you, rather than to a healthcare provider, and can be used by you in the manner you see fit. If you wish to use the settlement provided by a critical illness policy to fund medical treatment, you are able to do so.

But you are also able to use these funds to assist with your life following a severe and critical illness – you may be unable to work during chemotherapy treatment. A critical illness policy supplementing an international health insurance plan would allow you to receive your treatment secure in the knowledge that you have the financial assistance you require.

Life is risky; Don’t make it worse

When bad things happen, it is important to be prepared, not just for yourself but also for your loved ones. Whether you unexpectedly die, or you experience an accident that significantly lessens your quality of life, there are insurance products which can provide a complete safety net no matter what happens.

Many of the life insurance, personal accident, and critical illness products offered by CCW Global are able to provide global coverage; so even if you are outside Hong Kong you can live life secure in the knowledge that you have the protection you deserve.

CCW Global is able to provide free, no-risk, no-obligation quotes for life insurance products in Hong Kong and can help you compare the very best options for you and your family. For more information, please Contact Us Today.