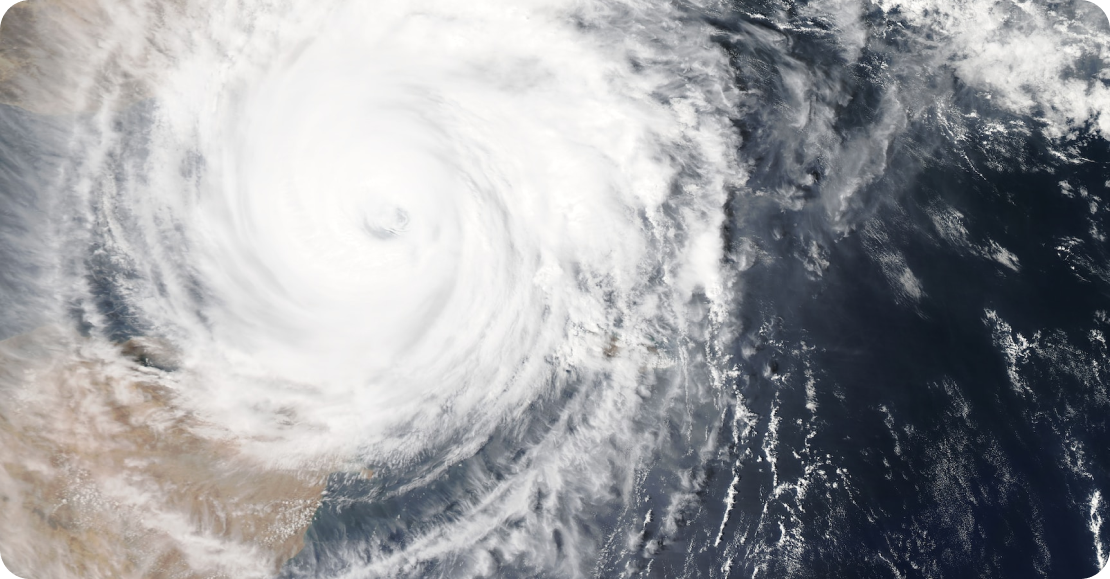

In a real typhoon, how much help is home insurance?

On 5:40am October 13th 2020 the Hong Kong Observatory raised the Typhoon number 8 signal for Typhoon Nangka. Raising the number 8 signal set a record for the Observatory as Nangka was 450km away from Hong Kong at the time; the furthest storm in over 60 years to trigger the signal.

While the Observatory was acting with caution based on their most relevant models, the fact is that Typhoon Nangka was extremely underwhelming, with much of the city experiencing mild winds and intermittent showers (if they experienced anything at all). Consequently the Hong Kong Observatory lowered the number 8 signal at 7:40pm on Tuesday October 13th, and Typhoon Nangka will fade into memory for Hong Kong.

This does, however, pose a serious question – mainly due to the fact that late or early season storms are generally much stronger than those which occur at the height of Typhoon season. If Typhoon Nangka did hit Hong Kong, with its expected strength, how well would your home have been prepared?

Typhoons are getting stronger and occurring later

Peak season for Typhoons in Hong Kong is from July to September. This is normally the time of year when weather conditions are perfect for storms to develop off the Philippines in the Western Pacific and blow through the islands into the South China Sea.

However, over the last decade severe storms have been hitting the city between May and October. In fact, since 2012 most Typhoons that have required a number 8 signal have occurred in August or later. These late season storms occur because of the impact of global warming on ocean currents and weather systems, and typically have far more power, and higher wind speeds, than those which happen within the season’s peak.

In 2017 this was amply proven by Typhoons Hato and Pakhar hitting the city in the course of week and causing roughly HK$ 8 billion in damages.

While Typhoon Nangka barely even impacted life in Hong Kong, aside from the normal Typhoon day work arrangements (which are old hat now that Covid-19 has everyone extremely practice at working from home), it had the potential to cause an extreme amount of damage. Thankfully, this was not the case. However, looking towards some sort of normality in 2021, we should be thinking about the prospect of more regular and ever stronger tropical storms, hurricanes, and typhoons. As such, in the wake of the underwhelming Typhoon Nangka this week, and following our look at burglary risks, it makes sense to investigate how Home Insurance can protect your property after a typhoon.

One of the biggest risks towards property in Hong Kong with regards to a Typhoon is the issue of Flooding. Hong Kong is already subject to severe rainstorms throughout the year, with many low-lying areas frequently seeing rapid flash flooding. Typhoons exacerbate this problem, bringing storm swells and surges that will create significant property damage to residences located by the effected ocean areas – which is most of the city in the case of Hong Kong.

Property Insurance starts with Fire Insurance

Any property owner in Hong Kong will likely have taken out Fire Insurance on their property at purchase. Fire insurance is the base form of property insurance in Hong Kong and will cover you against the rebuilding costs of your property (whether it is an apartment, village house, or standalone home) should you suffer a total or partial loss as a result of a fire. Fire insurance is extremely common as many banks will require coverage be in place before finalizing a mortgage to allow a property purchase.

However, as the name may indicate, fire insurance will only protect a property owner against losses which have their proximate cause as Fire. That is to say, a standard fire insurance policy covers nothing but losses where the original cause of the claim was directly attributed to fire, specifically a type of fire covered by the policy.

While proximate cause is the fundamental concept in relation to insurance claims it can be relatively tricky to understand. For the purposes of clarity, here is an explanation of how proximate cause would normally work in relation to fire insurance.

Let’s say that a fire starts in the home of a fire insurance policyholder. The fire is a complete accident and in no way related to any form of criminal or malicious intent, and is the product of an electrical failure in the homeowner’s fuse box. Let us also say that this homeowner is extremely conscientious about safety and has installed a sprinkler system. As a consequence of the fire, the sprinklers go off and cause water/flood damage to the rest of the policyholder’s property.

For this example, while the water damage was the largest portion of the policyholder’s claim, and while the policyholder only had fire insurance protection, it was the initial fire which cause the water damage. As such, the fire was the initial cause of the claim, the policyholder held fire insurance, so the water damage caused by the fire should be claimable under the homeowner’s Fire Insurance plan.

Typhoon’s are not noted for bringing fire, as previously mentioned above. So, in most cases a simple fire insurance plan is not going to be of great assistance in providing any substantial level of cover or protection in the event of a typhoon loss. Simply put, it is really unlikely that you’re claiming for a fire loss after a typhoon.

Fire “all risks” protection

A step up from straight Fire Insurance, which isn’t going to be terribly useful for a typhoon, is Property “All Risks” cover. Formally named Fire and Allied Perils insurance, this type of cover works under a similar concept to contents “all risks” insurance.

Under a Fire and Allied Perils property insurance plan your property would be protected against any damages which occur because of Fire, Landslip or Subsidence, Flood or Water damage, and other natural disasters or acts of God. Obviously, this is a more comprehensive method of protecting your property against potential loss, but because of the increased coverage it Fire and Allied Perils home insurance protection is also normally more expensive than straight fire insurance plans.

It is because of this additional cost that many property owners in Hong Kong will overlook Property All Risks insurance coverage when satisfying their mortgage requirements. Having just spent millions of dollars on a home, budget is going to be a very big concern when it comes to additional forms of protection and insurance. But a home is the single most expensive purchase a person will likely ever make in their lives, and not adequately protecting your property against the widest range of legitimate risks it will face means that you could be exposing yourself to a huge loss in a worst-case situation.

This is not hyperbole, as we mentioned above storms are getting worse. Without some miraculous climate control technology to stop hurricanes, typhoons, and severe tropical storms from occurring, there is simply no way to prevent this type of risk. As with so many different types of insurance, the only thing you are able to do is manage the impact the risk has on you.

Managing your typhoon property risks

Its not just in Asia where the storms are getting worse. The Atlantic hurricane season has been getting bigger and stronger for decades. According to the experts who watch these trends, a single typhoon or hurricane event can have a catastrophic impact on business owners and personal property owners. Millions, or billions of dollars’ worth of value can be lost should there be a direct hit by a Number 10 category typhoon in the future.

With so much upheaval during 2020 now is the right time to start preparing and securing your safety in 2021 – especially as we are heading into the traditional low season for tropical storm occurrences. Having to shoulder the rebuilding costs of your property should it experience a typhoon loss can be next to impossible in Hong Kong, and if you are holding a mortgage on the property you face losing it if you are unable to rebuild following a loss.

Fire Insurance and Fire and Allied Perils insurance are not going to stop Typhoons from happening, but they will allow you to pick yourself and your home up after a typhoon. Although Typhoon Nangka was not as strong as the Signal 8 that was raised because of it, the storm does serve as a timely reminder that its never too late to take the steps you need in order to protect yourself.

If you would like to receive a free quote for a Home Contents or Fire Insurance plan in Hong Kong, or if you would like to discuss your existing cover, please Contact Us to talk with an expert Hong Kong insurance broker today. Alternatively, you can also request a free quote by completing the short form at the top of this page.